|

7/2/2020 5:13:20 AM

|

|

British Pound Price Outlook: GBP/USD Bounces

|

British Pound Price Outlook: GBP/USD Bounces

It has so far been a brighter outlay this week for the British Pound as the currency has bounced against both the US Dollar and the Japanese Yen. Last week was marked by weakness in Sterling as sellers pushed each of those pairs down to fresh monthly lows; but at least a portion of that has been offset this week as both GBP/USD and GBP/JPY have thus far put in net gains, even as talk of negative interest rates from the BoE began to circulate through the headlines.To get more news about WikiFX, you can visit wikifx news official website.

This dynamic isnt necessarily discounting the prospect of negative interest rates as much as it may be driven by a related theme in risk markets. As discussed on the topic of Gold and then US equities, an interview from FOMC Chair Jerome Powell that was broadcast on Sunday night has helped to add some heat to the current risk rally, and this looks to have taken a toll on both the US Dollar and Japanese Yen getting hit with another bout of weakness; which has helped to buoy both GBP/USD and GBP/JPY.

In Cable, the big question is whether sellers are going to react to that next spot of lower-high resistance, and there‘s a few possible areas where that may develop: From the below chart current support showed up around the 38.2% retracement of the March major move; and the 50% marker from that same study is very nearby, just above the 1.2300 handle. That area helped to provide a couple of spots of support in late-April and then again in early-May. Above that, the 61.8% retracement lines up very closely to the 1.2500 level, producing an element of confluence that may constitute an ’r2 zone of resistance.

|

|

7/2/2020 5:23:09 AM

|

|

EUR/GBP Chart Setup Ahead of ECB Minutes, UK PMI D

|

EUR/GBP Chart Setup Ahead of ECB Minutes, UK PMI Data

Market sentiment appeared to have a risk-off tilt as the anti-risk US Dollar and Japanese Yen rose at the expense of the cycle-sensitive Australian Dollar. US equity futures pointed in the same downward direction while Asia-Pacific stocks traded mixed. RBA Governor Philip Lowe gave a speech, warning that monetary policy has its limits and that fiscal measures are crucial in combatting the coronavirus. Read the full report here.To get more news about WikiFX, you can visit wikifx news official website.

Euro Outlook Ahead of ECB Minutes

It is difficult to say how the Euro will react to the publication of ECB meeting minutes considering most of the attention now appears to be focused on the central banks tension with the German high court. It recently issued a ruling that deemed the 2015 asset purchases program and the subsequent growth of the ECB balance sheet to its current size illegal, giving the central bank three months to explain their policies.

The court said that unless such an explanation can be made, the Bundesbank will not participate in the quantitative easing program. ECB President Christine Lagarde defended the central banks decision and affirmed her support of the Pandemic Emergency Purchase Program (PEPP). This extraordinary measure by the ECB entails purchasing 750 billion euros of debt this year in order to contain the financial fallout from Covid-19.

If the underlying tone of the minutes strikes an unexpectedly gloomy tone, it could lead to heightened liquidation pressure in the Euro. Investors will be eagerly scanning the pages to find a more detailed outlook on the ECBs position for its PEPP program. In a recent interview, Mrs. Lagarde made it clear that monetary authorities “will not hesitate to adjust the size, duration and composition of the PEPP to the extent necessary”.

British Pound Braces for UK PMI Data

The British Pound may decline following the publication of flash PMI data for May. Manufacturing, services and the composite reading are expected to print at 37.2, 24.0 and 25.7 print, respectively. While this is far below the neutral 50.00 figure, it is an improvement from the prior month.

Worse-than-expected readings could inspire further rate cut bets from the Bank of England as officials contemplate the use of negative interest rates. Selling pressure in Sterling may also be amplified by growing uncertainty about the outcome of Brexit. Last week, EU and UK officials sent a chilling message about progress – or more accurately, the lack thereof – which subsequently sank the Pound.

EUR/GBP Outlook

EUR/GBP is testing the lower tier of the key inflection range between 0.8986 and 0.9091 (purple-dotted lines) where the pair had previously encountered both upside and downside friction amid market-wide volatility in March. If EUR/GBP shies away from clearing the multi-layered ceiling, a subsequent pullback may ensue. In this scenario, selling pressure may start abating when the pair hits familiar support at 0.8687 (red-dotted line).

|

|

7/2/2020 5:33:44 AM

|

|

Crude Oil Price Breakout Eyed, Will the Canadian D

|

Crude Oil Price Breakout Eyed, Will the Canadian Dollar Capitulate Up?

Growth-oriented crude oil prices climbed to a 10-week high as market sentiment broadly improved over the past 24 hours. The Dow Jones and S&P 500 closed +1.52% and +1.67% respectively as my Wall Street index attempted to make upside progress after idling for the better part of the past 3 weeks. The Canadian Dollar – which can at times be sensitive to swings in crude oil – struggled to capitalize on gains in the commodity.To get more news about WikiFX, you can visit wikifx news official website.

Recommended by Daniel Dubrovsky

What is the road ahead for Crude Oil?

Get My Guide

The upbeat tone in financial markets showed that investors shrugged off recent doubts over the potential viability of a coronavirus vaccine in the works from Moderna. Instead, traders may seem to be looking forward to a gradual easing in lockdown measures that should help restart economic growth. This may also explain why oil is now spending more time moving in tandem with global equities as of late.

Still, challenges may be ahead. Minutes from the FOMC meeting showed that policymakers see ‘extraordinary uncertainty’ and ‘considerable risks’ in the medium term. A few Fed officials also saw a ‘substantial likelihood’ of more Covid-19 waves. Meanwhile an oversight bill sent US-listed Chinese stocks dropping as tensions between the worlds largest economies seem to be heating up.

Develop the discipline and objectivity you need to improve your approach to trading consistently

Thursdays Asia Pacific Trading Session

With that in mind, Asia Pacific equities could echo the upbeat tone from the Wall Street trading session. This could bolster crude oil prices as the Canadian Dollar pressures resistance against an average of its major peers. Rising equities may also support the sentiment-linked Australian Dollar. AUD/USD will also be eyeing commentary from RBA Governor Philip Lowe.

Crude Oil Technical Analysis

On a daily chart, WTI crude oil prices have broken above ‘outer’ resistance from the beginning of this year. Follow-through at this point is absent. Rising support from Aprils bottom is also guiding the commodity higher – blue line. This has ultimately exposed former lows from August 2016 which could stand in the way as new resistance. A turn lower places the focus on resistance-turn-support at 29.11.

|

|

7/14/2020 4:11:45 AM

|

|

Winning $540K Lottery Ticket Sold At Dundalk Gas S

|

Winning $540K Lottery Ticket Sold At Dundalk Gas Station

Check your tickets; someone who bought a lottery ticket in Dundalk is more than half a million dollars richer!The Maryland Lottery said a Multi-Match ticket was sold at the Merritt Boulevard Shell ahead of Monday’s drawing. The winning numbers are 7, 12, 16, 21, 38 and 43.Get more news about 彩票包网开版,you can vist loto98.com

The winner has not come forward yet but will have an extended period in which to do so due to the coronavirus pandemic.

Whoever bought the lucky ticket will be able to choose from a $540,000 annuity or a $290,000 before-tax cash payout. The gas station will get a $1,000 bonus for selling the winning ticket.A $540,000 multi-match jackpot winning ticket has been sold in Dundalk.

The Maryland Lottery said a Multi-Match ticket was sold at the Merritt Boulevard Shell in Dundalk ahead of Monday’s drawing. The winning numbers are 7, 12, 16, 21, 38 and 43.

The winner has not come forward yet. They typically get 182 days from the date of the drawing to claim prizes, however, the Lottery has temporarily extended claiming deadlines due to Maryland’s COVID-19 state of emergency.The winner can claim the prize by mail or in person by scheduling an appointment at the Lottery Customer Resource Center in Baltimore

Whoever bought the ticket will be able to choose from a $540,000 annuity or a $290,000 before-tax cash payout. The gas station will get a $1,000 bonus for selling the winning ticket.

|

|

7/14/2020 4:31:14 AM

|

|

Vegas Is Big Jobs Loser, RV Hub Holds On in New To

|

Vegas Is Big Jobs Loser, RV Hub Holds On in New Tourism Economy

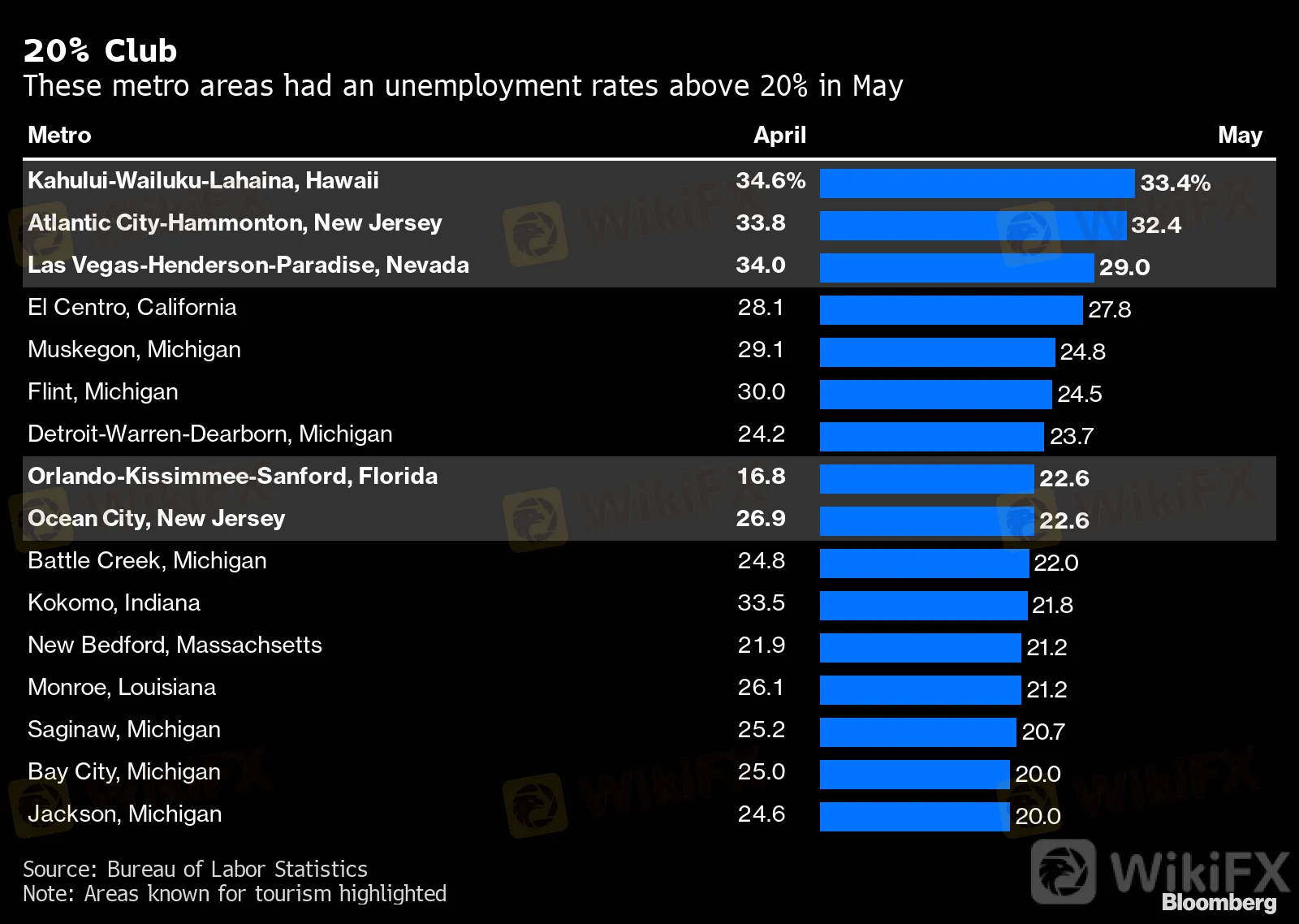

The American cities most dependent on tourism are suffering some of the worst labor markets in the coronavirus recession, with almost one-third of workers unemployed in vacation destinations from Hawaii to the east coast.To get more news about WikiFX, you can visit wikifx news official website.

The jobless rate in Kahului-Wailuku-Lahaina in Hawaii and Atlantic City-Hammonton in New Jersey surpassed 30% in May, the highest in any U.S. metropolitan areas, according to data released Wednesday by the Bureau of Labor Statistics. Las Vegas-Henderson-Paradise in Nevada was close behind.

Meanwhile, Elkhart, Indiana -- known as the recreational vehicle capital of the world -- saw one of the biggest labor-market recoveries in May, as its jobless rate fell back to 11.9% from almost 30%. RV plants have reopened to cater for surging demand, as vacation-seeking Americans shun crowded planes and hotels in favor of a more socially distanced kind of tourism.

“We have seen an incredible rebound and retail demand and dealer demand,” said Michael J. Happe, chief executive of RV-maker Winnebago, in an earnings call last week. Thor Industries, an Elkhart-based RV builder, has seen its stock surge more than 200% from March lows.

In general, tourist economies that rely on visitors flying in have been hit harder than those where more people come by car, said Mark Vitner, senior economist with Wells Fargo & Co. While there are signs of revival in some beach resorts and areas near national parks, “the recent surge in infections may put this rebound at risk,” he said.

Nationwide, unemployment eased to 13.3% in May and is forecast to extend the drop to 12.5% in the June jobs report, due out on Thursday. The BLS said the actual rate was somewhat higher after adjustment for data-collection discrepancies.

|

|

7/14/2020 4:40:21 AM

|

|

EUR/USD Undecided Ahead Of The ADP Non-Farm Employ

|

EUR/USD Undecided Ahead Of The ADP Non-Farm Employment Change!

EUR/USD is trading in the red according to the Daily chart, but it is still traded above a major support area, a further drop is far from being confirmed. The pair seems undecided, but I really hope that the US data will give us a clear direction these days.To get more news about WikiFX, you can visit wikifx news official website.

The US ADP Non-Farm Employment Change could shake the markets today, the economic indicator is expected around 2850K in June, versus -2760K in May. The fundamentals will take the lead in the last three days of the current week, so you should be careful because the high volatility could ruin your trading account.

Also, the US is to release the ISM Manufacturing PMI, Final Manufacturing PMI, Construction Spending, and the ISM Manufacturing Prices later today, some good figures could support the USDs growth in the short term. The FOMC Meeting Minutes report will be published as well tonight, you should be ready for significant movements in the US session.

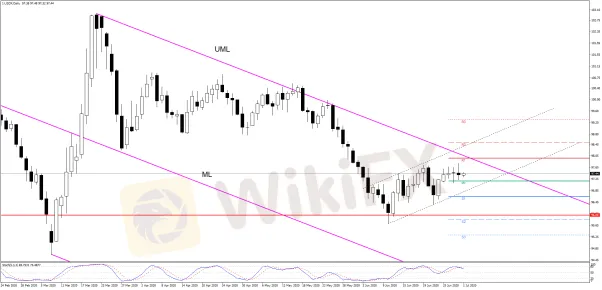

EUR/USD is still undecided because the US Dollar Index has failed once again to resume its short term rebound, to approach and reach the upper median line (UML) of the major descending pitchfork.

The USDX is still traded within the minor up channel, it moves sideways right above the weekly PP (97.18) level and is waiting for the US data to dictate direction. As Ive said in my previous analysis, EUR/USD could drop deeper in the short term only if the USDX will resume its rebound.

A USDX‘s valid breakdown from the minor channel followed by a further decline will push the EUR/USD towards fresh new highs. USDX’s bullish reversal will be validated only by a valid breakout above the upper median line (UML) and above the R1 (97.97) level.

USDX could edge higher if the US data will come in better than expected today, while poor figures will weaken the USD which it could lose significant ground versus its rivals.

EUR/USD continues to move sideways right above the 1.1200 psychological level, it has failed once again to close below this downside obstacle. Still, EUR/USD is under some bearish pressure as long as it is traded below the upper median line (UML) of the descending pitchfork.

Monday‘s failure to reach and retest the upper median line (UML) has signaled a potential further drop, but the sellers weren’t strong enough to force the quote to close below the 1.1200 and to make another lower low.

EUR/USD is trapped between the upper median line (UML) and the 1.1200, a valid breakout from this pattern will bring a great trading opportunity and will validate the short term direction.

A downside breakout and another lower low, a drop below 1.1167, will attract more sellers on the Daily chart, while an upside breakout from this triangle and a valid breakout above the upper median line (UML) will invalidate a further drop and will validate another leg higher.

The minor triangle will be a continuation pattern if EUR/USD will make an upside valid breakout and if the USDX will drop again in the short term. However, a USDX‘s rally will push EUR/USD in the seller’s territory, the pair will extend its corrective phase towards the 1.1 level and towards the median line (ML).

|

|

7/14/2020 4:51:47 AM

|

|

Learn how to use the Bollinger line to accurately

|

Learn how to use the Bollinger line to accurately

Bollinger Bands, the invention of John Bollinger, is used to measure a markets volatility and identify “overbought” or “oversold” conditions. This little tool tells us whether the market is quiet or loud. When market is quiet, the bands contract and when market is loud, the bands expend.To get more news about WikiFX, you can visit wikifx news official website.

It can be seen from picture that the Bollinger Bands is a chart that is displayed over the price. When the price is stable, the bands are close. When the price moves up, the bands spread apart. The upper and lower bands measure volatility, or the degree in the variation of prices over time. The volatility bands automatically adjust according to changing market conditions.

Most charting programs default to a 20-period, which is fine for most traders, but you can experiment with different moving average lengths after you get a little experience applying Bollinger Bands.

The concept of standard deviation (SD) is just a measure of how spread out numbers are. If the upper and lower bands are 1 standard deviation, this means that about 68% of price moves occurred recently are CONTAINED within these bands. If the upper and lower bands are 2 standard deviations, this means that about 95% of price moves occurred recently are CONTAINED within these bands.

As you can see, the higher the value of SD you use for the bands, the more prices the bands “capture”. You can try out different standard deviations for the bands once you become more familiar with how they work. Honestly, you don‘t need to know most of this stuff to get started. We think it’s more important that we show you some ways you can apply the Bollinger Bands to your trading.

If you said down, then you are correct! As you can see, the price settled back down towards the middle area of the bands.

What you just saw was a classic Bollinger Bounce. The reason these bounces occur is because the Bollinger bands act like dynamic support and resistance levels.

The longer the time frame you are in, the stronger these bands tend to be. Many traders have developed systems that thrive on these bounces and this strategy is best used when the market is ranging and there is no clear trend. You only want to trade this approach when prices are trendless. So be mindful of the WIDTH of the bands.

Avoid trading the Bollinger Bounce when the bands are expanding, because this usually means the price is not moving within a range but in a TREND! Instead, look for these conditions when the bands are stable or even contracting.

Bollinger Squeeze

The “Bollinger Squeeze” is pretty self-explanatory. When the bands squeeze together, it usually means that a breakout is getting ready to happen. If the candles start to break out above the TOP band, then the move will usually continue to go UP. If the candles start to break out below the BOTTOM band, then price will usually continue to go DOWN.

Looking at the chart above, you can see the bands squeezing together. The price has just started to break out of the top band. Based on this information, where do you think the price will go?

This is how a typical Bollinger Squeeze works. Setups like these don‘t occur every day, but you can probably spot them a few times a week if you are looking at a 15-minute chart. There are many other things you can do with Bollinger Bands, but these are the two most common strategies associated with them. Go ahead and add the indicator to your charts and watch how prices move with respect to the three bands. Once you’ve got the hang of it, try changing up some of the indicators parameters.

|

|

7/14/2020 5:17:13 AM

|

|

Why Relative Strength is Important in Forex?

|

Why Relative Strength is Important in Forex?

As forex Traders we are always trying to get an edge in our pursuit of increased profitability. We study the charts and look for those setups that get us really excited. We have our risk management in place, proper position sizing and we have a target, that if met, will generate a nice risk/reward ratio that over time will make a generous amount of pips. We‘re well on our way to a profitable career as a Currency Trader. We’re all set….To get more news about WikiFX, you can visit wikifx news official website.

Yes, BUT, I would submit that you forgot one of the most important things to consider before you even look at a chart. The fact that you are pairs traders, implies that you are long one currency and short another currency, hence a currency “pair”. Have you thought about what pair you have picked and why it might not be the BEST pair to trade?

Unless your analysis starts with relative strength and weakness first, you might not be in the most uncorrelated currencies to give you the biggest move based on what you thought was a good setup on a chart.

When you are able to group the JPY pairs together and identify the % change on all 7 pairings, it will give you a snapshot of the strongest and weakness currencies at the present time. You are then able to determine the pair that has the best odds of providing the biggest move when there is the catalyst to provide energy in the pair.

Because every trade is a relative value trade, you can simply look at the % change and can quickly identify the pair that will give you the potential biggest move for a specific currency in play.

For example, if there is news on the USD, what currency would you use to pair against the USD to give you the biggest move if the news is bullish or bearish? Truth is, it won‘t be the same pair. If it’s a bullish USD, then one of the other 7 currencies will be the weakest and if bearish, one will be the strongest.

By grouping the JPY pairs and identifying the most uncorrelated currencies, you can take your trading to the next level. Yes, you can be profitable without this analysis, but I would submit that it will help move the odds further in your favor and increase your risk/reward ratio.

As Traders every time we can give ourselves a better edge and move the odds in our favor, thats a winning strategy.

|

|

7/28/2020 3:08:12 AM

|

|

Tokyo Olympics postponement leaves UK firms in lim

|

Tokyo Olympics postponement leaves UK firms in limbo

With the Tokyo Olympics delayed to 2021 due to Covid-19, UK firms have seen their plans disrupted

The world of sport has been severely disrupted by Covid-19, with headlines highlighting everything from cancelled events and empty stadiums, to athlete health and spectator safety.To get more news about Binary option, you can visit wikifx news official website.

But the pandemic has also had a huge knock-on effect on businesses that support the sport industry - and nowhere is that more apparent than around the Tokyo 2020 Olympics.

The Games, originally due to start on Friday, have been delayed until summer 2021, affecting UK firms who had been fortunate enough to win work.

British companies were set to provide parts for water sport courses, ambulances for horses, power generators, and Olympic venue construction - not to mention softer services such as sponsorship expertise.Aggreko provided generators for London's 2012 Games, including the cross-country cycling events

Glasgow-based Aggreko is the only British firm among the 66 official Tokyo Olympic partners and sponsors, and has been part of the Games since Seoul 1988, providing generators.

Its initial Tokyo contract value was around $200m (£158m) and Aggreko said earlier this year it expected that to increase to around $250m. It has received more than $100m in payments so far, as the Japanese hosts continue to deliver scheduled instalments.

|

|

7/28/2020 3:29:41 AM

|

|

$7,128 Lost Due to a Payout Withdrawal Delayed for

|

$7,128 Lost Due to a Payout Withdrawal Delayed for 18 Months

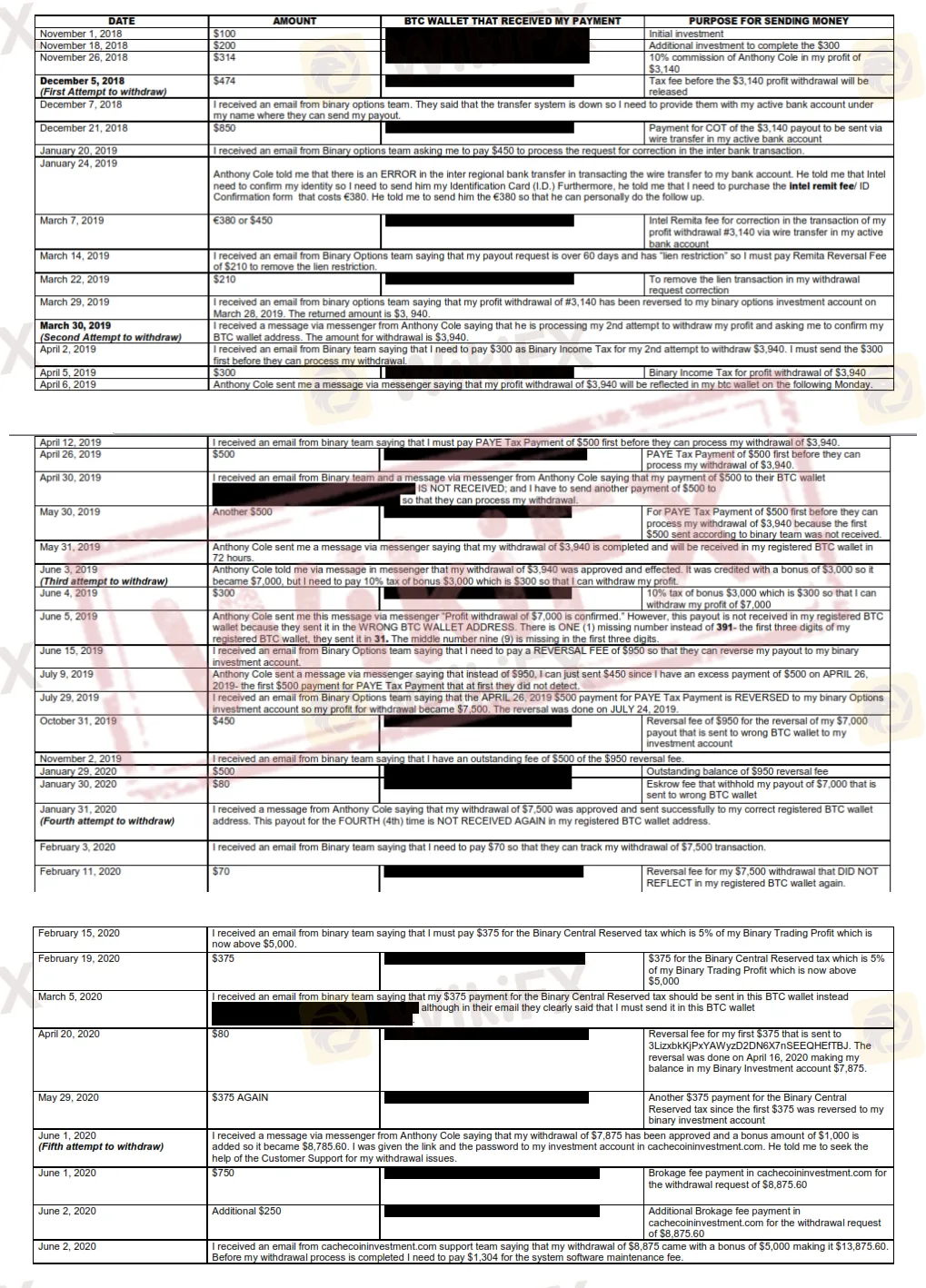

It is important to be alert and focused when trading forex. There‘s so many potential scams everyday and everywhere that you’re easily got scammed if you happen to choose some wrong brokers.To get more news aboutBinary option, you can visit wikifx news official website.

Recently, WikiFX team received an investors complaint against Binary Options, an investment platform based in UK. An investor claimed that she was misled and scammed by this illegal broker and lost $7,128.

The nightmare started when she registered her account at Binary Options in 2018. Then she met a FX/CFD trader of Binary Options, named Anthony Cole on Facebook. According to Anthony, the investor will get $2,190 in seven days if she invests $300.

The investor therefore started to invest on the trading platform Binary Options and gained some profits at the beginning. But when she wanted to withdraw the profits, Binary Options asked her to pay 10% commissions ($1,304) first.

“I have started this very PROLONGED withdrawal since November 2018. To date, I STILL NOT RECEIVE even $1 in my account at Binary Options.” The investor told WikiFX, “Binary Options team and Anthony Cole endlessly asked me to pay too much fees even if the errors in my withdrawal process were not caused by myself. I tried to compromise and paid as they requested. But they never returned my money withdrawn.”

Per investigation, we found that Binary Options is rated at only 1.12 on WikiFX App. According to the latest risk warning, this broker currently has no valid regulatory status. Please stay away from it!

So far, WikiFX App has included profiles of more than 19,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, to protect investors fund in forex trading. Click here to download the WikiFX App, a guide to less risks and safer investment.

|

|

7/28/2020 3:36:34 AM

|

|

U.K. ‘Did Not Want to Know’ If Russia Meddled in B

|

U.K. ‘Did Not Want to Know’ If Russia Meddled in Brexit, MPs Say

The British government failed to investigate whether Russia interfered in the Brexit referendum and a full intelligence inquiry must now take place, a panel of lawmakers said.To get more news about Binary option, you can visit wikifx news official website.

Members of Parliaments Intelligence and Security Committee accused ministers of deliberately avoiding the question because they did not want to know whether Russia had tried to interfere in the European Union referendum.

Ministers refused to authorize a retrospective investigation into the 2016 vote on European Union membership.

The recommendation for a full-scale review is a key point in a long-delayed report on Russian involvement in British politics by the watchdog which oversees the work of the U.K. intelligence agencies.

It is a politically explosive subject and one that Prime Minister Boris Johnson will be reluctant to revisit. The aftermath of the Brexit vote split the country, leading to years of turmoil and uncertainty for business and bringing down two prime ministers.

Johnson, who led the controversial pro-Brexit campaign, is now in charge and seeking to negotiate a future trade deal with the EU. He will want to avoid reopening past debates about the vote as he has pledged to move the country on from the past divisions over Brexit.But the panel of politicians said a full inquiry -- with findings made public -- would be essential. “It is important to establish whether a hostile state took deliberate action with the aim of influencing a U.K. democratic process, irrespective of whether it was successful or not,” the ISC report said.

Members of the panel criticized the government for failing to try to establish what had happened sooner.

|

|

7/28/2020 3:48:26 AM

|

|

U.K. Budget Deficit Swells to Record on Coronaviru

|

U.K. Budget Deficit Swells to Record on Coronavirus Stimulus

Supply Lines is a daily newsletter that tracks COVID-19s impact on trade. Sign up here, and subscribe to our Covid-19 podcast for the latest news and analysis on the pandemic.To get more news about Binary option, you can visit wikifx news official website.

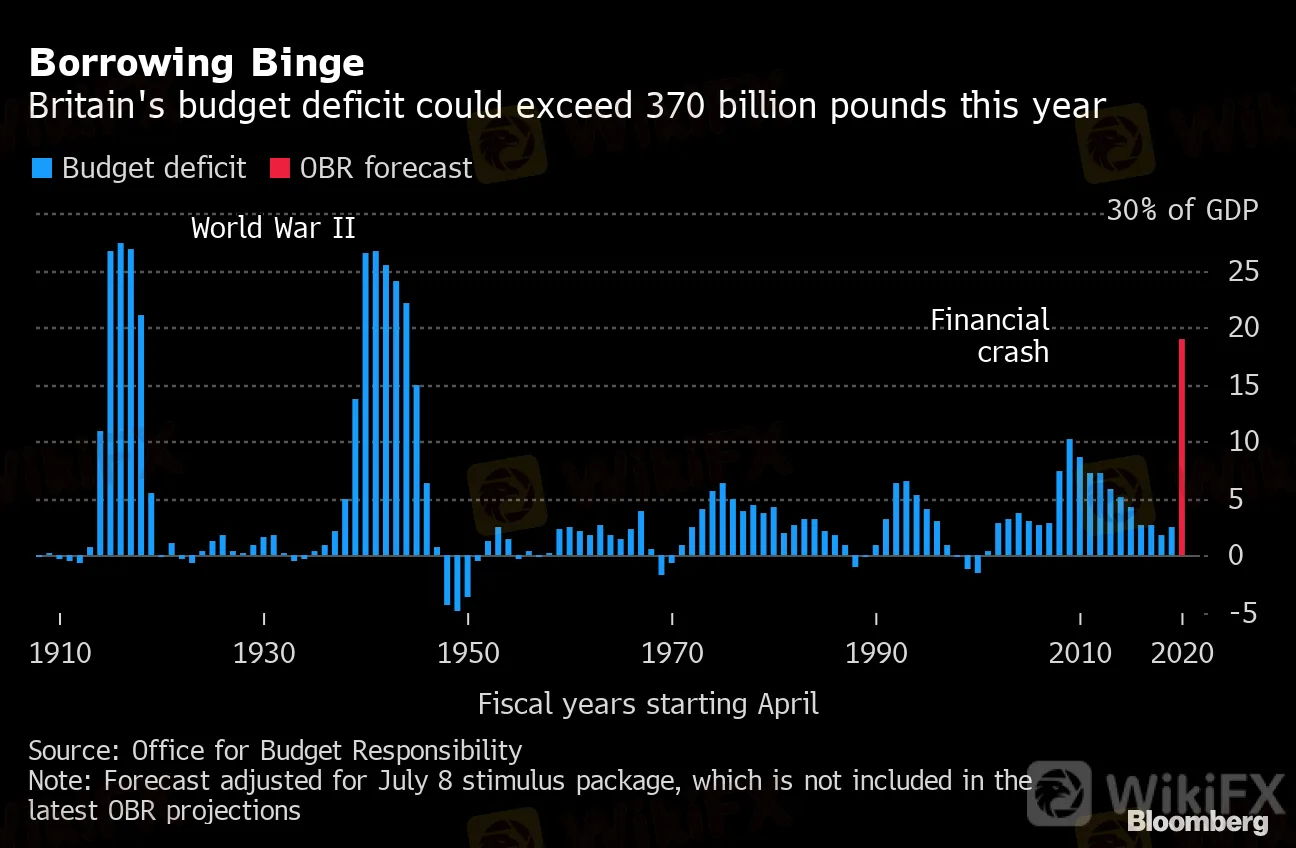

U.K. government borrowing soared to almost 130 billion pounds ($165 billion) in the first three months of the fiscal year amid the towering cost of supporting the economy through the coronavirus crisis.

The Office for National Statistics said Tuesday that the budget deficit stood at 35.5 billion pounds in June alone, leaving debt at 99.6% of GDP -- the highest since 1961.

Chancellor of the Exchequer Rishi Sunak has committed more than 190 billion pounds of government spending and tax cuts in an effort to save jobs and keep businesses afloat. Combined with the damage inflicted by the worst recession for at least a century, that means a deficit that was forecast to be just 55 billion pounds this year is now on course to exceed 370 billion pounds, according to the Office for Budget Responsibility.

The pound was at $1.2689 following the report, up 0.2% on the day. Ten-year gilt yields were at 0.15%, close to a record low.

At around 19% of GDP, the deficit projected for 2020-21 would be the highest since World War II and almost double the levels reached after the financial crisis a decade ago. And its not the most pessimistic scenario outlined by the fiscal watchdog last week.

Government debt could take decades to bring down to more sustainable levels, economists say. But while the stock of debt is high, the cost of servicing it is more affordable than ever, thanks in part to massive Bank of England bond buying in the secondary market which has pushed down gilt yields. Tax rises nonetheless appear inevitable once the crisis has passed.

The latest snapshot of the public finances showed government revenue fell 13% between April and June compared with a year earlier, with receipts down across the board. Spending meanwhile jumped over 40%, driven by a 70% increase in departmental outlays.

A cash measure that determines government bond issuance stood at 47.1 billion pounds in June, taking the total for the fiscal first quarter to 174 billion pounds. The Debt Management Office is on course to sell around half a trillion pounds of gilts for the year as a whole.

|

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

|